Episode Transcriptions Unedited, AI Auto-Generated.

Speaker 1: 00:05 Welcome to the social community and show where it's our goal to help you learn. Growing. My person, Christianity come today, book review time. Uh, we're doing the richest man in Babylon when the old timey classics, like those old ones, uh, you know, I was, I was looking at, I dunno, some, a bunch of different lists of like whatever top seven, top 10, top 20 whatever books you should read. And I want to say I've read a good majority of them. And this was one that was like on a top of a lot of lists that I hadn't read and never, never even thought about reading. So when we were looking for a book to do next, I was like, you know, let's, let's try this. Like it's different I guess. I don't know about different, I mean it's, it's definitely a Oldie but goodie I guess.

Speaker 1: 00:59 I don't know. It's its own world. And the thing, when I first, when I first was going through it, I just went through like a normal book, just, you know, front to back. And it's not, I think in my opinion, is not designed for that kind of reading. Well, I'm going to sit there and write. The book was designed from a bunch of different stories or something like that and like, yeah, I guess it was originally, um, W was a series of pamphlets that was distributed by the u s bank and insurance companies from 1920 to 1924. So when I learned that it made more sense, like, oh, these were a little short stories that they're like, they wind up putting into a books in 1926. I was like, this makes more sense now why it was all these like repetitive kind of stories. Like the same message was through each story.

Speaker 1: 01:45 You know what? I don't have any stories that are six, seven, eight stories, whatever. There is all kind of, they're all kind of similar. I'll kinda really need it. I don't know. I guess I like the, like the genre of it. I like the way they talk. It's like that old English art thou yeah. Yeah. Some of that is a little hard. It's like, Gosh, did somebody spellcheck this grammar check this? Like who is the copy editor on this? Like Jesus Christ. That's how they talk back. Right. Anything else other than they got to keep it. Keeping in mind that, that's the thing real quick, the summary of the book is, is a, a classic financial and motivational guy that was as lead generation is the personal and monetary success, invaluable lessons of finance are relayed through legendary tails in the ancient and set an ancient Babylon. Uh, so that, I mean, it's kind of the premise of the book. It's all about, and it's, it's, I love it. Lately in the past, I don't know, a few years, I've gone back a lot of his old texts like, oh, it's still old stoics stuff. And like some other things we're talking about. Um, and it's like the, we're talking about the same shit 200, 300, 10, five, six, 2000 years ago. It's like, where did we go wrong?

Speaker 1: 02:57 We know wrong, man. I, it's just, you know,

Speaker 2: 03:00 we have that element in a less right, that we all have that greed. We all have that. Um, I don't know, three is the right word, but we all have that desire, right? Our, our innermost desires as a signature or was he your freewill? Like what? Uh, you know, but we just, we all have that within us so that we just, you know, we, I'm going to say we forget the basics, but we know it. We know what to do. We just for some reason are not wants something else.

Speaker 1: 03:36 We just, yeah, we don't do it, do it. That's the thing is that that knowing, doing gap, right, we know what we should be doing, but doing it is not as easy and a lot of these things I wish I learned when I was younger. I think about these things now. It's like, like the courts, we need, like the core premise through the whole book is save 10% of of your gold period. Like, like don't, don't, don't even think about it. Like don't just say 10% and live on the rest. They like, you're, you're living on which all you have now. So if you threw off a fucking one gold nugget on the side, like what's the difference and you'll get used to it. And I was like, I wish I knew that younger. Like no matter what, hold that 10% put that dollar away for every 10 bucks you make. You know? And don't think about it. Don't touch it. Don't look at it.

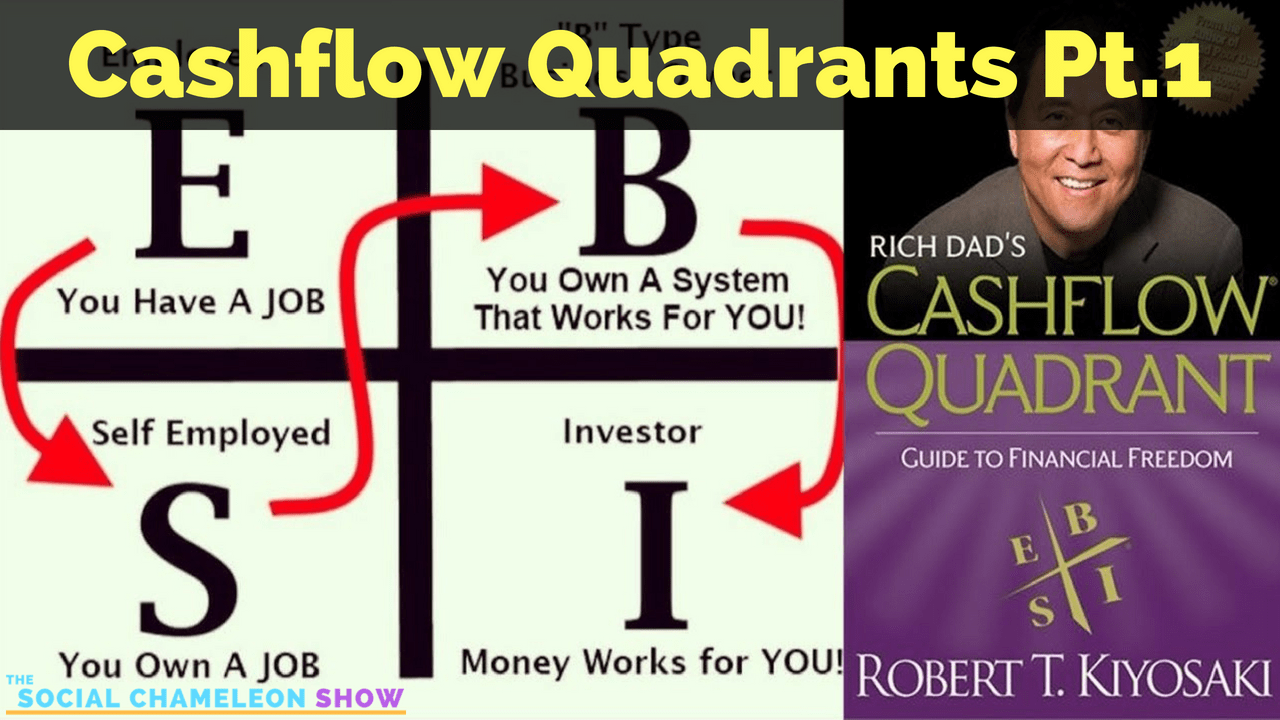

Speaker 2: 04:23 Yeah. But I mean they just, I mean even the book talks about it like, you know how they use their overzealous like yeah, me and made lots of investments today didn't pan out. You know what I mean? Like in my, in my lifetime I are done. Yeah. It's like, oh you see this, you know, you get this hot tip, not so hot. Right. We don't know anything about it. The sure bet like the, the cat lose. Yeah. Just like you go for it because the odds, the odds are so great. Like you say, if I win, you know, and he just, you just keep putting that stuff on there. I mean, I guess, cause I Read Rich Dad, poor dad. To me that's a more modern day tale of this story. Um, very different books. But I mean the premise is the same. Like you got to invest your money, right?

Speaker 2: 05:14 You've got to put your soldiers right. Every dollar that you have is another worker that's going to go out there for you, make more money. Um, you know, but so I, I knew not to live with myself if do dads and all this other kind of stuff and not by all these frivolous things. Um, you know, but at the same time I didn't learn. The other lesson which is in this book is like knowing what you're investing in. I didn't know what the head, I'm guessing and I would just put my money in because if I was going to win or not.

Speaker 1: 05:47 Yes. I think too, and sometimes you get, you feel like you know, are going to I guess like, hey my friend and he's good at this or this person told me and know I trust them. And to say you just go in and you don't know what you don't, you can't fact check. You can't, you know, you know, validate anything and then you want to, you know, not, not knowing what you're putting your money into. Like they're sending the book, you know, like, you know the brick maker knows bricks. Don't trust him to tell you 200 shoes. He doesn't know anything about that. I thought that was funny.

Speaker 2: 06:19 The brick mayor told me it was going to get me some diamonds and then I was like, look, good, this guy makes his money in bricks. You really, he's going to get you diamonds that are worth it. Right.

Speaker 1: 06:31 What does he know about Jules? Yeah, he knows about bricks, but it's a good lesson that you were going to, you know, who, who are you listening to? Like, you know, listen to your uncle or your cousin or your friend. Like what are you doing? What have you done? Like you don't know shit about shit. Like you saw some special on PBS and I are an expert. Like I don't think so.

Speaker 2: 06:52 Yeah. And I, I guess, I think we talked about this the other day and like all up hats, um, episode of her thing where the guy was like, just trying to pick stocks, right? She's like, well, what research did you do? You went on your phone and like looked at something like, Ooh, all your real research. And it was like, I was like, I don't know. I guess he Kinda, you know, you've got to do that. But that's the other part too is like, how do you know how to do this research? And those are kind of the things that this book doesn't necessarily get into, but you know, just, just fair warning. Like if you're going to put your money into something like go seek an expert, go seek. And what I mean by an expert is not someone who's just going to go take your money and do something with it. Like, yeah, we'll see somebody who's going to give you advice or tell you a little bit about something, I don't know. Anyway,

Speaker 1: 07:41 get, get a coach, get us somebody, pay these guys for their money. It's worth the hundred dollar consultation fee or whatever, $200 you know, to save you thousands or, or, or out of. That's the thing I liked in the book. One of the stories they're talking about like, uh, it's like I wind up getting like around a bunch of guys that would vet deals and discuss them and find loopholes and it's like, that's how I started learning. Like that's how I started making my investments. I think there's one about the father told him, go go beat it for 10 years and come back and let me know what you learn if you can make money. My fortune. I think that was, you know, but that's the thing like that's, we've talked about as many time. If there are a lot of, you heard the Cliche, you know, you're, you're the average of five people you hang out with.

Speaker 1: 08:23 If you hang out with people that are doing things, making money, doing deals, guess what you're going to do. You're going to learn that stuff. If you're hanging out with people hanging on the block, drinking beers gets triggered to do know how to buy beer. Like you gotta know who you're hanging out with. What are they doing? What are they, what's a crowd you're with? Are you learning from guys that are doing deals, vetting deals or are you guys hanging out with fucking talking shit about something you saw in shark tank? Like what are you doing?

Speaker 2: 08:47 Yeah, that's Kinda cool. I like the whole thing. Like if you're going out to drink beers, you're going to learn how to buy beers. I mean, right Ronnie. But I mean, you do, right? You know where all the sales, all, you know, you know what days they go on sale, right?

Speaker 1: 09:03 Tuesday lungs is on sale and then Friday is the thing at Walmart. And I say,

Speaker 2: 09:08 yes,

Speaker 1: 09:09 but you, but if you hang out with a different kind of crowding building, listen, Hey, uh, earning reports coming out. You know, I got a guy that, you know, that knows a guy that works there or whatever, or I work for a company that did a consultation for them and this is something's coming down like we should look into, you know what I mean? Sit within the law. But if you don't, I'm trying to say like if you're hanging out with guys that are knowing things or doing things, you know, it's like, Hey, there's this guy, I know he's, he died in his buildings coming up for sale and this is a good deal of the kids don't want it. Like, let's jump in on it. Like if you're hanging with those guys, that's the deals you're going to find, you know?

Speaker 2: 09:40 So, yeah, that's true. That's true. But I mean, getting back to the book though, I guess, I guess you're right. I agree with you as far as save 10%, that's kind of a drive home, a message of the book. But he goes, talk about other stuff, right? Like the seven curses in purse, uh, Michael rules, those kinds of things. There's a lot of good rules. They're all essentially themed. But there's a lot of good rules. You want me to get into that seven, seven curses of an purse and then seeing like, it's funny cause like as I was reading this book, I was like, man, if I put context, it's like millennials start reading this and he's like, what are these guys doing with women? Women's bags? And it just, it's not a purse. It's basically a coin purse is what they call it. It's basically a leather pouch that you'd put your coin.

Speaker 1: 10:33 I think the modern equivalent I can think of is the crown royal bag.

Speaker 2: 10:38 That's,

Speaker 1: 10:39 that's what I, that's what I think of the purple bag. Your crown world comes in. That's what I think of the day.

Speaker 2: 10:44 Those guys drinking man. Like how would you know what that list,

Speaker 1: 10:49 I spent many a times finding the sales on alcohol

Speaker 2: 10:52 on that Crown Royal Bag. Right. It's not about the alcohol, it's about the crown royal. I'm expressing a visual what

Speaker 1: 11:01 they would use and, and and and gold coins are not bitcoins. None. The theory them,

Speaker 2: 11:06 they're real chunks of stamp. Yeah. That's other thing about this book too. It's like they didn't write on paper Bro. They should know beaches, tablets, collect clay tablets. I was like, Ooh, yeah,

Speaker 1: 11:21 you've got to, I mean you're not careful. You had to be at that. I got these five roof,

Speaker 2: 11:24 four rules. Shit that was, she got with it, I don't know. All wet or whatever. Like you have to be crazy. Yeah. I mean I guess it was better than carrying around a book cause if you're booked, got wait. There it goes. All of your information. But uh, yeah, I don't know.

Speaker 1: 11:41 I wonder if I would like to think ink would hell hold up a little bit more in a weather than clay tablet,

Speaker 2: 11:47 but I don't know. I'm, I didn't really nice picture of it. Send the museums.

Speaker 1: 11:54 All right.

Speaker 2: 11:56 But anyway, uh, I guess we'll get into the seven curses the first verse one. Ah, ah, ah, ah, started my purse to fattening. So it sounds so nice. You know what I mean? Just the word that he used my purse to fattening. I was his name. Our cod advises on saving 10% of your annual income to start building up your wealth or purse, right? For every 10 coins. Now placing first make out to be mine, that purse start to fatten at once and it's increasing weight. We'll feel good. And I had and bring certification, satisfied, satisfaction to die soul like gosh, like read. And I was like, I can't read it without laughing.

Speaker 1: 12:47 It's hard because it doesn't make sense in our way of speaking now it's like it's so fragmented and yeah, yeah. Refer to myself in that third person. Yeah, but there we go. I mean, rule one, the first thing you gotta do to accumulate wealth, pay yourself first like that is, is to me like the whole, one of the hardest things to do is pay yourself first and then pay your bills and pay everything else with the rest. Because what you want to do is like pay all your bills and everything and then do what what you want with the rest. You know what I mean? And it's hard, especially when, you know what I mean? I'm making a lot of money or you've got a lot of bills, a lot of debts or whatever. Like that's hard. It's super hard and I guess that's what I'm saying earlier. Like I wished I was hammered home to me as like a child. Like no matter what you knock this out and don't ever think about it at see it. It's not real. Like this is for a later venture or something or when Shit hits the fan, you've got this cushion. Like I only maybe in the past four or five years really understood like dad is crucial and everything else happens.

Speaker 2: 13:58 The rest of that. I guess for me, I've always understood that, but, but I guess I've always also fallen off the way I can, you know, you know, because you take this 10% and this is just my, my theory and how it worked out for me. And it's like you want to take this 10% and because I grew up with rich dad, poor dad and all that stuff, I didn't want to throw my 10% in the bank and just let it sit there as a savings account or whatever the case might be. I didn't even want to go do an IRA kind of thing. I want it to go buy investments. I wanted to go chase stocks or can cheese real estate, do all that other kind of stuff and buy all these classes. So like I took that 10% and I, I used it on things that didn't really have a yield for me.

Speaker 2: 14:44 Um, I, I guess the only thing I have to take away from that is my education now. So like I know better where I spend my money. Right. Maybe I will see. Well, because you know, now when I start putting that money away, I'm going to watch it a lot better as we get old there. But you know, just be careful what you invested in and where you put it in the bank is the best place to put it. Um, you know, you gotta go find something out there that's worth it. Um, we've talked about many things on this show, so go back to the previous episodes and figure out, you know, where, where are you going to put that? 10%. But yeah, get it, see it and invested in making sure that those dollars are working for you. Definitely. And then number two, control the expenditures.

Speaker 2: 15:29 I mean, stuff we don't hear about all the time. And this is thousand plus year old advice. Stop keeping up with the Joneses. You don't need the new Gucci. Like you don't make it, you know, especially if you're not paying yourself first. Like if you got the new Jordans and the new, you know, the new this and the new Gucci Belt and it's like you can't eat and like you're putting $3 gas, like, you know, you might, you might want to rethink that. Yeah, that's, that's definitely something that I think America is really good at. I've heard Gary Vee say before, it's like America is really good at selling you stuff that you don't really need. I mean, I was just talking to my mom the other day and she's like, Oh, you know, the new iPhone that's coming out. I was like, Ma, look, I was like, I got, this is the iPhone seven right here.

Speaker 2: 16:20 It's got a case. I got the iPhone seven. Like it works fine. It's brand new. I mean, you can get a refurbished nowadays for like maybe 300 bucks. Um, but the new iPhone is like $1,000 and this one iPhone seven straight from the factory, brand new, um, for 50. It's less than half. Like, I mean, you, you don't, do you really need that new iPhone. I love you ma. But, uh, it's talking to other people out there. It's like, do you really need the new iPhone or can you work off something that's half the price or go get, get one on sale, you buy one, get one free. Like those kinds of things, you know, read the fine print and make sure it's actually free in that you're not going to charge or something. And I don't know, just controlled I expenditure was again, if you're putting yourself first 10% away and then with the rest of you you utilize that. Well, um, you know, again these are back to basics. That's the one thing I was thinking about in the past maybe year or so. You know, I started thinking about more of the things I was buying in like, like do I need this thing? And I think this is the longest I've had a phone in a long time. Like this is going on two years now. I had the same phone. I'm a guy to

Speaker 1: 17:50 blond man. Yeah. I, that's, that's my style. Like, you know what I mean? I love, I love being an early adopter, first adopter. Like I liked that kind of stuff. That's fine, you know. But I started thinking about like, do I need like the new phone? Like do I need a day of downtime to play with the new phone, set everything up, signing into this dot. Another like, why? Cause I got a marginal improvement over the last version. Like you know, so, and I've been thinking about like things like that, like um, you know, going, going on like, oh, I'm not going to pick this thing up. And I just put it in my cart and I was on, I leave and I go away. And I'm like, sometimes I forget like, Oh shit herself man, Amazon Carr Lake. And I looked, I go back and look at my card and I'm like, I didn't need this shit man.

Speaker 1: 18:39 Just delete it all, you know, like, but like I've been thinking about those types of things. They'd be like, I, I like gadgets, I like, I like to spend stuff like that. But I'm thinking like how much money of it waste, how much things like around the house that I don't use or use often or wind up giving away or whatever it is. And then I, I was listening to a podcast, my dad and the guy was saying the average American has 300,000 things in their house. Like that's fucking mind blowing. You know what I mean? Like, I mean, I mean obviously as granular, like, you know, you've got 12 spoons and 14 forks and 13 nights, but start to think about the other things. Like, you know what, maybe I'll have, you know, a hundred bucks. Okay. You know, but that's not a significant percentage of the things in my house, you know?

Speaker 1: 19:23 And I don't have a lot of things in my house. I don't like a lot of things. But you're saying that like, I'm looking at all this stuff. I haven't, if you're watching this video, take a look around. If you're water's funny, you know? Yeah, yeah. Hair clips over there. I, like I said, some of the stuff I see, I got hair clips, no clothes. I don't have old costumes in my closet. I have two sets of golf clubs that I don't use anymore. I got to candles over there. It's like, why do I need candles? I just take a look around this stuff that you have now. Do you need that? Right. Well, some of that for profit, but imagine how much money you've already sunk cost. It's gone. I'm gone. He's gone. Like you'll never get it back. Sometimes it's even debt that you're paying 22% a month on.

Speaker 1: 20:10 You know, that's the thing I've been thinking about lately. You know, uh, I, you know, I think about, you know, how many of you have a storage locker that's got stuff in that you've never seen? You don't need, you don't use like that. You're paying $100 a month for like, why, you know, and that's the things I've been thinking about lately. You know, like, why am I buying these things? Why am I buying this stuff? Um, and then could I be saving this towards something else? A greater investment, like another, you know, another investment or a bigger investment, whatever it is. Or, you know, you know, knocking off some student loans or something like, you know, different things that are kind of lingering around know. But I think we should take grass on that subject. Think about what's around you, what you're spending your money on. Is it

Speaker 2: 20:54 necessary? I'm sure we can live without it. And as I call, I'd say advises confused not by unnecessary expenses with dietist hires. Rice does that bad.

Speaker 1: 21:10 And then we'll move on to number three. Like if you're saving 10% you're keeping your expenses in check. Guess what? You can do it. Number three, you can multiply that gold. Like if you're not doing those things, you don't got no gold to multiply. You can't put your soldiers out to work for you. And that's the thing that hit me a year or so ago. I was like, damn, I don't, I don't, I didn't feel like I had enough soldiers to go out to work for me. Like I felt like I was stagnant in my progression, in my invested mean thing and opportunities, you know. So I started like, where's the leak? Where's the thing?

Speaker 2: 21:41 Yeah. And for me when I went out there and try to make it multiply, I failed over and over again. Um, I guess now that I'm looking at this rule and I'm thinking about the episodes that we've done past, um, some of the good things to do, um, especially from Tony's unshakeable and from Paula Pant stuff that we've seen, um, go out, get a vanguard account, get some ETFs going. Probably a good solid start. Absolutely. To repeat that message over and over. I'm sure you can be like me and try to do real estate deals and try to do stock market deals but really make too much money in that. I mean, I made profit in some, in some of my lost money, so just be careful with that. Yeah.

Speaker 1: 22:29 And um, even, uh, something as simple as is a high yield checking account where you can get it, you're getting, you know, 2% interest like that. Super easy.

Speaker 2: 22:41 Yup. Got a shop for those though. Those aren't common

Speaker 1: 22:44 right there. There are, um, if I can remember, I'll leave some links to some I know of, but your checking account, uh, you're getting 2%. Like there's, I don't think there's a savings account you can get to percent. I don't think you get a CD at 2%. You know what I mean? Like, so the, these are things that are so easy, so simple. You're knocking, knocking your 5%, you're 10% savings and then now you're getting 2% for doing nothing but having money in a checking account. Like, you know, these are good things, but you may have a business and you got like, you know, 10, 20, 50, you know, I heard a guy had $1 million sitting in their company checking account just in case. And he's like, why the fuck is, is not making me any money? You know? And he's like, he moved it to up, um, uh, high yield checking account. He's, he's a 2% on his million dollars that they keep around and its cash reserves,

Speaker 2: 23:29 you know, so things to think about, definitely guard I treasure from loss. That's hard. You know. And this even goes back to, I don't know, was that the first or second episode or the First Book Review? We did write principles. Ray Dalio, that's all he's about is finding investments to protect you against the losses. Um, if I, if I remember correctly in this part of the book, like this is like one of my things, like the guard was like talking about the wall and stuff like that. He's like guarding a wall and like there isn't it? Oh, you know, people are going to break through the wall and the guards like, no, he's like, nobody's broken through this fall. I was like, I was like, Damn. But back in the day, that's what they did, right? They created the castle, they put guards around it so that nobody could come in and, and take, take the king's treasure. Like, you know, you got to do the same thing here. Nowadays we do that with insurance or you know, you find investments hopefully that will either whether the test of time or you diversify your investments, you know, things like that that can protect you have one in one of your legs on your stool goes down. You still have the other three or four legs and keep your flow. Like, you know, those are kind of the things that we do. And hobbies.

Speaker 1: 24:51 Yeah, you been bad there, you know, um, a lot, a lot, a lot of people I know and, and things that I've learned is, you know, from, from the get go, you know, what's your, what, what's, what's the downside here? What, how much can I risk if I'm putting up $10, how much am I going to lose? I am, I am I am I at risk of losing five 50 cents a dollar. Like knowing that like this goes south, can I lose a dollar for every 10? That's fine. I'm okay with that risk. Potentially I'm going to make 20. You know, there's a lot of, you go out there, you can find a lot of stories. Richard Branson. Classic Story. You don't know it. When he started virgin airlines, he went to Boeing and say, listen, I'm Elise, he's planes. If doesn't work out, I'm going to give him back.

Speaker 1: 25:30 And, and no, nobody's ever done that deal before. He's like, I have nothing to lose. I have zero to lose. I'm not on the hook. $800 million for these planes. Like, Hey, this doesn't work out. I returned them. Nobody's ever had structured a deal with that before. Everyone thought he was crazy to even think, boy, he was gonna do it. And they did. That's, that's his risk. Nothing, zero. Just whatever effort and whatnot went into it. Planes like that's a big expense for an airline is, is spending, you know, 30, 40, 50, $80 million on a plane and you go under, you've got a plane sitting there. Yeah. Think about that when you're getting ready to it. Something like, what's my downside? He can I lose that? You know, like, um, I think it was in principles or some other books or maybe was an unshakable, he's like, you know, I can lose four out of 10 times because I know I'm going to win and like I'm okay with that. You know, cause I'm going to, I'm going to hit more often than not because I have myself set up that way.

Speaker 2: 26:23 Yeah. And you know, I, I guess it's in today's world because I've lost so much and the investments that I've done, I, you know, I just take it with a grain of salt. Um, but at the same time, don't be, I guess to secure or worried about the security of your, you know what I mean? Cause if you are going to go, just put it in something like bonds or something that doesn't really yield much. You know, your money's not really growing for you. You know, so like you gotta find the balance with that. Find something that's gonna make your money grow. Um, you know that over time it's going to grow versus in getting, just putting your money in a 2% checking account. Like, if that's all you're doing, then that's not really enough to carry you forward. And like you would bring to have to multiply harder than that.

Speaker 1: 27:15 Yeah, don't understand your risk tolerance and, and, and you know, and if you need to start small and up your risk tolerance, I'll be risk tolerance. I'll be response, maybe set aside money like this is going to be money that's going to be for risky stuff that I'm not comfortable with and I'm going to, I'm okay losing five, 10 grand, whatever it is and that's fine. I 90% of my money's protected. That's an option for people to do things and try things in up your risk tolerance and see, you know, if you have a goal in mind to begin with, like I want to be here in 10 2030 years, you can work back and say where, what do I need to be doing? Where do I need to be traveling to get there? You know, and you can, you know, understand your risk tolerance like I need to be at, you know, 8% because you know, I'm looking at a 5% growth. If functions about three to 4% and like, you know, you've gotta be thinking about those kind of things in which way you're headed.

Speaker 2: 28:03 Yeah, I mean again, basically you want to try to protect yourself from losses the best so that you can, but you know, also remember the third rule, you have to make your money grow too. Yeah. And then I guess we can get into the fifth kill a profitable investment. I don't know, I just accent comes from, but I don't know what you're trying to go with. But uh, yeah, I mean that's, that's definitely um, you know, and I, I just want to note the thing in here. It says make diet dwelling a profitable investment. You know, just be careful again, you know, keeping up with the Joneses. Like if you're buying a four bedroom house that you just really don't need the extra three bedrooms in there or the extra two bedrooms in there. You know, the thing behind this is making it a profitable investment.

Speaker 2: 28:55 And I guess I'll read here, cause I love this accident. Arcada buying versus renting your principle residence and using your residents to establish a business. I recommend that every man on the roof, that shelter with him and his, uh, it's so funny. But anyway, um, you know, back then this in Babylon, we're talking about people who are farmers or sheep herders or cattlemen or one of the guy was like, he, he heard it camels. Like, you know, so back in those days you bought this land and that's where you grew your livestock or that's where you grew, you know, your, your vegetables or potatoes or whatever it is you're going to sell. And like you're making your home a business. Nowadays that's a little bit harder to do. Right. You know, and it, not everybody can do it, but at the same time, it's like if you're able to do that, like that will build wealth over time.

Speaker 1: 29:56 Yeah. And I'd like to, to kind of go on this a little. Um, we, we get stuck a lot in, you know, thinking we, you have to buy a house, you have to do these things and stuff, you know, it's, it's okay to rent sometimes. That's great. Maybe that's good for you. Um, there's a lot of, of, of both of people that do not own homes, they rent wherever they are, where they go. Um, there are Ramit Sethi from I, I want to teach you to be rich. He doesn't own anything and he's very wealthy and he advocates for renting. Um, there's a good on the New York Times they have a rent versus buying calculator. I'll link to that for you guys. You want to evaluate like is it better for you in your situation with your life and what's going on in your life to rent or buy? It may be help you not feel like you're obligated to, to, to, you know, to be buying something. Or maybe you want to get out of the house you're in and you're like, well no, I should be paying, should be paying somebody else's mortgage. She on that. That's not the greatest idea sometimes.

Speaker 2: 30:54 Yeah. And again, I just want to make sure that you read the rural correctly. It says make thy dwelling a profitable investment. Yeah. And that's just kind of where I live. I live in a, in a, in a high rate, I guess the average or the mean price of real estate and whole why is like 700,000 for a home. You live in these areas of high valued real estate. It doesn't always make sense to buy. It's like, I want to go buy something. It's going to cost me, you know, upwards of five, $600,000 to buy here, traditional home here in Hawaii. And like, that's not necessarily a profitable investment for me. You know what I mean? It's like, it may make things for me to rent because in the long run it's cheaper. Um, and I can't, you know, I'm, as of now, I'm in the healthcare business or I'm in the real estate business.

Speaker 2: 31:49 I don't, I don't need a home to raise my sheep or my teammate camels or you know, what it mean, grow my crops. Like that's not what I'm trying to do and, or accomplish here. So just now again, it says make the dwelling a profitable investment. You know, and I guess just on a side note, for those of you people that have homes where you can convert them into duplexes, that's a nice house hack that you can do to you one side of your house and you rent out. You know what? You got this four bedroom house that you never use the other two bedrooms in the house. And guess what venture, not somebody's Airbnb made back home. A profitable investment

Speaker 1: 32:29 that's going to be a basement you could convert to something. Like there's a lot of things you can do, you know. Um, I know a guy, he, yeah. The company he owns, he has the company rent his house from him 14 days out of the year and he works from there. And that's something that they do to kind of hack his little thing or whatever. I was like, that's pretty clever. Like I have your company renting your house from you or for you or whatever. So I thought it was pretty clever. There's lots of ways to make these kinds of things

Speaker 2: 33:02 profitable. Yup. And then what is the next one here?

Speaker 1: 33:08 Ensure a future income, which goes back to the other stuff. Like if you got something to say, he hasn't, it's locked away. You can put those guys to work and then you have a future income. Somebody is paying you dividends, something's paying you every month or whatever it is. You're getting tax breaks. I mean, there's a lot of things, right?

Speaker 2: 33:26 Yeah. And there's lots of ways that you can do that. Um, again, you know, since we were just talking about real estate, like you don't have to buy a home to live in, you know, you can go buy, you know, and again we're just fraud is real. Um, but the, you know, when you buy your home to live in as a first time home buyer to get their rate, when you signed the paper, it says that you're only going to live in there for 12 months. That's all you're obligated to do. You can go buy investment property, be again, just make sure you meet all the stipulations of the first time home buyer, but you can buy a property and that you are going to rent out in the future but live in it for 12 months or 12 months to go back to renting.

Speaker 2: 34:09 Rent that puppy out, make some money. You know what I mean? Like we're talking about investments that are going to make money in the future. Things like real estate that will provide you rental income, our way to do it. You can also buy stocks and or companies that provide dividends. So they will, no matter what happens to the stock, whether it goes up or down, that company will pay you a dividend over time. You know, we talked about it earlier, you can do ETF's. Um, and nowadays you can do all kinds of stuff. They got four o one k they got a four or three B. Like they have all different types of investment tools that you can use.

Speaker 1: 34:47 Yes, go out there, find a professional, don't be cheating. Pay these guys for your time. It's gonna save you thousands if not tens of thousands of dollars.

Speaker 2: 34:59 Nice. We ran it for the last one, number seven, number seven, increased ability to earn. And I was like, hmm. You know, we've talked about some of these things before. You know, it's like keep, um, keep developing your own skills to increase your, invest in wisdom and also increase your earnings are so like, you know, what can you do? And we talked about this in previous shows before, like what are you doing at your job? Are you sitting there on your phone all day or are you actually, you know, going around to make the difference and be put forth that you're to be a good worker. It's you're up for or you know, taking extra responsibilities or that you, you wanted to move into a management position. Um, some of the other things we talked about on previous shows asked your boss if he can work from home.

Speaker 2: 35:51 That's like the number one thing. It's going to save you time. It's going to save you money on gas, going to save all kinds of things. You can take your job and apply it so that you can work from home and work something out with your boss. Like that's the number one thing that you, that most people, if they can do it, do it and it's going to save both you and the company money and time definitely allowed to add on to that. I don't know what other stuff would talk about. Are we talking about?

Speaker 1: 36:17 There's so many ways, um, to, to up your skill level, to add more skills, to be calm, more of a, you know, somebody that you looked to at work saying we got problems, we got things, we need solutions. We're going to come see ransom. We're going to come see Tyson when it come see Billy job. Joe. Like he, you know, he, this person is a, you know, as a master in these sort of things are there, well competent in through three things. Like everyone else is good at doing tasks a but you know, ransomed man. He's going to do a task a, B, and c and he's very knowledgeable in each of those because he's used, he's used, he's, he's done each of those jobs. Well he's you, he's learned. He says he's got those skill sets. Like if you're that guy, if you're the, if you're the guy, you know the guy or the Gal, that person whenever you want to call it that you know, can go to each department and do the jobs that can go and do these different things that you become valuable, your skills become valuable, you become a multifaceted threat, you know, just because you're done with college or don't at school or whatever, your vocational training, your education doesn't stop.

Speaker 1: 37:18 Like there's so many things like the world is changing fast and rapidly and if you're not keeping up, whether it's with technology, whether it's maybe with looking for the next career and your evolution, like you've got to be doing these skills and keep upgrading yourself. Spending some time every day on the weekends, reading, going to classes, going to trainings like there's so many ways to, to get to the next level. Maybe it's at another company, maybe somewhere else where you pick up a note, two, three skills and now you're qualified for something else. Like you never thought maybe you could do or whatever. Now you've gone from, you know, 80 grand a year to 125 because you spent six months at night school. Like, you know what I'm saying? There's so many ways to, to earn your income. You can do side hustles microbusinesses I mean we've talked about so many of these things.

Speaker 2: 38:04 Yeah. And then just on the side note, I mean also thing here is like maybe you make enough money. Yeah, yeah. I mean maybe you are a high income earner already and you make enough money and it's like you don't need to increase your ability to, you know, bring money in. Um, or even if you're not there sometimes if you just work on managing your expenses like little, a lot of money that you think you have actually becomes more. It's like, okay, how can we save or cut expenses? Like you can spend time on cutting of your everyday living so that the money that you do make is more than enough. And I guess the last thing is if you have all of that taken care of, you make enough money and you're putting it away, you know, goals, look at some time at what your investments are doing.

Speaker 2: 38:49 It's like okay, I have this rental property, you know it's been like three years cause I have a property manager just run it like go look at the numbers, go sit down with your property manager and be like, Hey, what's going on with my property? And be like, Hey, you might notice you're losing money there. You know, or we'll look at your 401k or go look at your four, three B plan and go look at the fees. It's like Dang, you know, as a car, are you getting ripped off on fees? Look at, look at, you know, we'll take some time in your investments. If you're day to day job is already good and you make more than enough money. Yup.

Speaker 1: 39:23 There's plenty of plenty of ways to, to, to to, you know, earn more by like grants was saying, cutting fees, cutting expenses. I mean that's back in the other room before you'd be surprised. Like, I don't know how many times I see see things for like, oh sign up for this service so we can cancel out things you don't use. I'm like who, who doesn't go through those every quarter? So I'm was looking every, every quarter, every few months or so late. Is there, is there something for a business expense and I'm still paying for it and I'm not using anymore. I need to reevaluate. Do I really need to be paying for this? And I'm always going through stuff I read probably about every quarter or so. Like do I still need this? Is it still a good expense in my that I forget about a membership to something or an annual renewal that is going to creep up on you. And next thing you know you've got to, you know, something that pops up.

Speaker 2: 40:10 I was told recently that, you know, if you go to best buy and get those zero interest down, um, either on their furniture, their stove or whatever, um, be careful of those. Um, cause I was just taught that it's not just zero interest down. Thank, give you a credit card. And guess what? Their credit card has an annual fee.

Speaker 1: 40:30 Oh. Oh. And if you don't pay off those balances in the, the um, promotional term, you get hit with a balloon interest. I understand that. I mean I'm just assuming,

Speaker 2: 40:42 well, are responsible they have the cash and they're just taking zero interest down. Yeah. I'm just saying just read the fine print because you may look like, Hey, what is this $60 charge here?

Speaker 1: 40:52 It's an annual fee. Yeah. Yeah. I got, uh, at the beginning of October, the beginning of the year I got charged with $120 annual fee for a credit card processing services I haven't used in like six months. I'm like, I thought I canceled that. And then like you, you didn't cancel it all the way. Like, and then they had changed their terms of service and they weren't charging a membership fee. And then they suddenly were, and I was kind of in this limbo period, I had to go and I found out all this paperwork to get my money back. But those are the things like that was an oversight for me. I ignored the emails, like I don't use that anymore, whatever. And, but I got hit and it took me hours of time to get back 120 bucks. It's like, it's really, you know, these are the things, the classics, gym memberships and like different subscription services and different things like that. This pop up and come here and you're like, I don't really use this. Raise your thing anymore. And it's the odor and pack or whatever. You know what I mean? Like his thoughts. There's so many of these services now that you know, just show up to your door. You know, I have things automatically shipped to me, you know, and once in a great while I'm like, Dang, I didn't need that this month. I should have skipped it or something. But

Speaker 2: 41:58 again, this, you know, make, make that earnings better, di investments plentiful. So that's it for the seven curses of the purse. You want to get into the five laws of

Speaker 1: 42:12 gold now, you know, I think, um, that's, that's, you know, that's one of the stories. One of the things in the book go out there, you know, read them. You know, I, I, like I said, I would go one at a time. Um, I think these are great like bedtime story kind of stuff. If you've got kids like, no, really, I mean I teach my kids is, a lot of them would be good stories. I think they're great stories and then guess what they're gonna keep hearing, Hey, 10% save your 10% maybe 10% the 10% you know, that's the premise of a lot of, you know, all these stories, every rule and all the rules on every scribe tablet was save 10%. You know? And if you're not only, not only are you teaching your kids and said are your early age and you can put this into practice and grandma, it gives him money when he gets some money from their birthday or whatever it is, you know, and it's all gonna be a reminder you like, damn, am I saving 10% like one of the episodes we did.

Speaker 1: 43:06 I'll say, you know, I need to go back and reevaluate what I'm saving because I've earned more since the last time I set up my automatic things. And I, and I was like, Oh wow, I'm way under and I want to doubling my contribution because I didn't take the time to go back and reevaluate that. But these repetitive things that we're doing, especially with this show reminds me, you know, if you're reading this to your kids and remind yourself a Tang. So last time I checked on that, I've got a raise. I don't think I increased my savings raider, I increased my four one k contribution or whatever it is. Yeah, that's true. Yeah. So they'll just count that stuff. Go, go read this book, read the different stories, a lot of good stories. Um, I said, I think to me, the one thing that stood out in this, I was like, man, I just thought of like, this is a good children's book. You know, that's what I thought. Like it's going to probably go over their heads. But the repetitiveness of hearing this all the time, I start to add,

Speaker 2: 43:57 you bring up a good point, cause the stories, you know, don't read the whole book to them, but just pick a story. You know, whether it be the Campbell merchant or the, the bread maker or something like that and just, and just talk about it, you know, um, I think they make really good stories there about money. Um, stuff like that. You can make them funny. But um, for me, I guess before we close out, I just kind of want to talk a little bit about what I think is the underlying messages book and I'm not really sure. Um, you know, cause most people think, oh, it's just about saving 10% is Tyson said and all that kind of stuff. Um, when you get down to the last part of the book, they talk about this guy who's a slave and he's trying to become a free man and you know, this person is explaining to this guy, he's like, look, he says, the man with the soul of a slave will be come one no matter what his birth.

Speaker 2: 44:48 And I was just like, I was just thinking about that. I was like, I was like, Dang, there's so much truth to that. No, as like to the person who you really are. And then it's like, it talks about the soul of a free man. It's like the soul over free man will become respected and honored in his own city despite his misfortune. And I just thought to myself, I was like, how true are those words? Like it's about who you are as a person. It's about what's up here. It doesn't matter how much money you have, doesn't matter whether you're a free man, doesn't matter whether you are a slave. They who you are is going to show no matter what happens to you. And I think kind of driving it home is, you know, the last part of the book where he talks about work, he's like, I like work.

Speaker 2: 45:33 It is the best friend that I know. It's a core well done, is good for the man who does it. It makes him a better man. Like it just, again, it's not talking about work, he's talking about the men, you know, and it's just kind of like the person behind everything that's going. So all of this stuff that we're talking about, um, you know, I think there's a, there's a secret underlying message messages. This book is just being a better person, being a better person, doing the right things. Those are the things that are going to, you know, not only attract gold or coin or wealth to you, but those are the things that are going to attract opportunities. Those are the things that are going to attract the type of people that you need in your life to make this happen. Those are the kinds of things that when you face adversity, like you're going to know what decision to make. And I, and to me, I dunno, it's kind of like an underlying message in this book that I don't think people talk about. So just kind of wanted to mention it in this book anyway. I digress.

Speaker 1: 46:33 No, and that, that is, you know, I love that, that you found that hidden message. I, I didn't really, I didn't really see that, but it's true. Like, think about what we're slaves to and it's not, don't think of it in, in, in, in the kind of the common sense of the word. Like what are you, are you slave to what? To Jordan's, to Gucci to, to, to, you know, eating fancy restaurants and what are you a slave to? Like we're all slaves to something like is it controlling you as a controlling your life? Is it controlling, you know, your decisions? Like do you have to work this shit? Fuck job cause you're a slave to Gucci. Like why, you know, it was like, think about it, like what are you doing? What are you being enslaved to? You know? And it takes some time to reevaluate that.

Speaker 1: 47:19 Don't you know, just cause you're not of a certain race or or know demographic or whatever, it doesn't mean you're not in safe to something. We all are, you know? Yeah. So take that seriously. Like evaluate that. Like, I'm not, you know, no more, not, again, I'm not to be a slave to this shit and these things and what Instagram tells me I should look like or buy or wear or hang out with or whatever, you know, think, don't take that lightly. Yeah. Awesome. Any other, any other key takeaways from this book? I know we went long on on, on the one. I think you're right. I mean, even the five rolls up gold or basically just, you know, similar, similar things and you know, we've got to leave something. You put a meat. Yeah, definitely. Yeah, yeah, no, no. Yeah, those are like the two most, I don't know, famous of the stories I guess, or the rules or whatever.

Speaker 1: 48:11 So we threw it in there, highlight them or a little bit of whatever. We'll link Ali, that's up in the show notes for you guys. Easily referenced those two rules to different, they're basically saying, um, it's like twists on things, different stories, different things. But, um, but as, as, as, as for, as for giveaways, uh, at the time of this recording, I'm trying to do something with a more kind of a give back thing for May and this should be coming out in uh, beginning of mid May. I'm not sure. I'm trying to do, um, job trying to, trying to see about getting into this thing about pledge 1%, um, from um, uh, episode I did with the guy. It's an interesting thing. Um, what it is is, you know, pledging 1% either of, of your time, of 1% of, of, of the products you make at your company.

Speaker 1: 49:01 Um, or 1% of something else. I can't quite remember. But that's what I'm looking for for, for May. If you're interested, what's going on, head over to the social convenient.show/pick me figuring out what's going on, getting into this stuff. We got lots of fun things. We're trying to work with more people, always learning and discovering new things and we we really want to share them with you and hook you guys up and give you guys, you know, acceleration, whether it's in, it's in health, it's in, it's in self growth, it's in something. It's, this is just something from from us to you guys to help you guys on your journey on things we find in people we partner with. And then I'll, I'll link to this book and then I also linked to the, um, some of the high rate checking accounts I know of and I'm the rent calculator for interested on knowing should you keep renting or should you get out of your house and, and start renting or whatever it is you want to do.

Speaker 1: 49:52 I'll link to those two things for you guys. And then this week's challenge, haven't said it enough. If the book hasn't said it enough, are you saving 10% at least? You know what a dollar for every 10 bucks. Like I know it's hard when you, I been there and fuck you. You're looking for quarters under the couch. Like, it's tough to like throw 10 bucks on the side and say, I can't use this, you know? Um, but you've got to start making that habit of saying, I've got to put 10% away and I can't it and start to live on the 90 like you're going to make adjustments, we're going to adjust, we're going to have to do something a little different. Whether it's make more money or it's caught a little something here and there to find that 10% if you already got 10% or you got your 20 or whatever you're doing, how about one more?

Speaker 1: 50:43 One more percent. They just, what's, you know, you're doing 200 bucks. Like what's another, you know, 20 bucks like you, you're not going to feel it necessarily. I'm, I'm, I'm pretty damn sure about it. And you get used to it, you know, try one more percent, see what it's like. And like I said, I went back and I reevaluated, you know, what I was doing and it's like, it feels good to say, Whoa, that's, that's getting up a little quicker than I'm used to. Like, you know, it's nice, but go out there, do your 10 if you're doing your 10 you know, throw one more on it. Maybe you throw 10 more or five more on or whatever's comfortable for you. You're a goals, your risk tolerance. Go do it. Get some money in the bank so you can find opportunities and cash in on him.

Speaker 2: 51:21 Yup. And then for our final thoughts, just remember you're a golden stream of income comes from you nowhere else. Yeah. Everything you have is within you. You just got to get out there. Find it. Yeah. Don't pay attention to what social media is saying. Don't pay attention to what your mom is saying. Don't pay attention to what your friends are saying or your boss saying about you. This is you. You have the ability, you have a gift to this world that you can give and your golden stream of new income's going to come from that gift. Get out there, go find it. I'll do it.

Speaker 1: 52:01 And if you're looking for people to join you on that journey and you want them to maybe get a little help, little knowledge. Maybe you guys team up, you know, share this with them. You know, that's the best way to support the show is to share with somebody. Um, if you'd like to leave a review on your favorite podcast APP, if you're watching the video version, you know, throughout the little thumbs up on Youtube, on Facebook, wherever it though the thumbs up on that really do appreciate it. Does help our show. Got to Miami, it amazing guests. We a lot of coming up. I'm sure you guys have enjoyed the ones in the past, uh, in between shows. You guys can connect with us all week long. Social, can you show on Facebook, Instagram, Twitter, youtube, and all your fire, your podcasts, apps for past episodes and links to everything we talked about here today. You can visit the social chameleon.show and until next time, keep learning, growing and transforming into the person you want to become.